Our Performance

The Hillside Factor(y)

Our careful selection of investments is based on factors, which means that the companies that we own for you are expected to consistently deliver above average profits. Using strategies proven over time and disciplined investment principles, we generally produce exceptional results for our clients.

+

–

The Hillside Factor(y)

Data drives decisions

We focus on a select group of companies that meet our strict selection criteria: profitability and consistency

discipline

Consistency generates exceptional results

An Investment Approach Ideally Suited For Your Objectives

Hillside closely consults with our clients in determining the investment approach that is most aligned with their objectives and personal preferences. There are three different tracks we offer, and one of them is certain to be right for you.

In all three models, the PM looks to own a concentrated group of high quality companies that are watched very closely. The PM also has the flexibility to hold high levels of cash should the general market conditions warrant a defensive posture.

+

–

Hillside Balanced Growth (click to open)

Investment Objective: The “Hillside Balanced Growth Portfolio” has been designed to address the objectives of clients and their families who wish to have the majority of their portfolios’ exposure to equities while maintaining exposure to more conservative asset classes to provide balance.

The goal is to realize returns in the 5-7% range (net of fees) over a period of 6 to 8 years.

This model may never hold less than 30% of its assets in fixed income investments and must therefore also not hold more than 70% of its assets in equities.

To learn more about the portfolio, please be sure to email us.

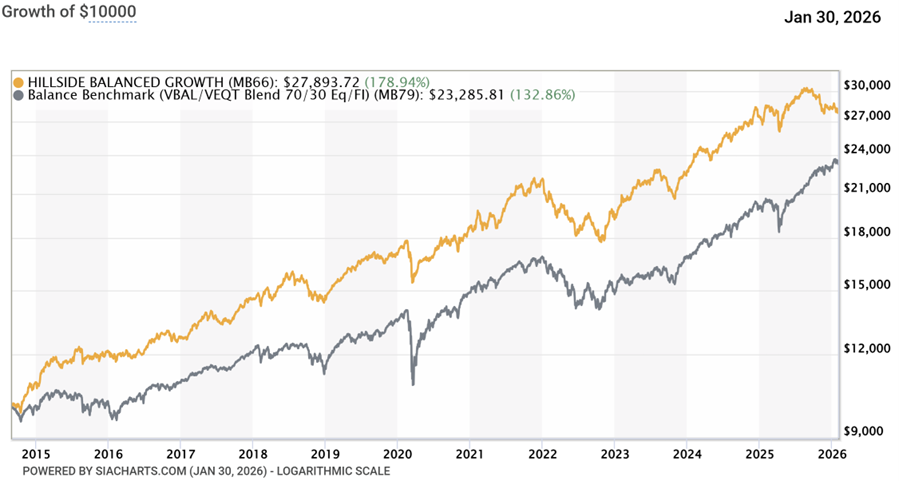

| Performance to January 30, 2026 | YTD | 6 Mo | 1 Yr | 3 Yr** | 5 Yr** | 10 Yr** | Inception ** |

| Hillside Balanced Growth* | -1.11% | -6.34% | -2.24% | 11.47% | 8.37% | 8.77% | 9.40% |

| HBG Benchmark1 | 1.40% | 9.52% | 12.83% | 14.31% | 9.34% | 8.96% | 7.68% |

Past performance is not an indication of future returns.

* Performance is presented gross of fees. **Inception: Sept 2, 2014. Results beyond 1 year are annualized.

1 Hillside Balanced Growth Benchmark: 75% Vanguard Balanced ETF & 25% Vanguard All-Equity ETF

Source: SIACharts.com

| Hillside Balanced Growth of $10000 to January 30, 2026 |

Legend:

Hillside Balanced Growth

HCG Benchmark

+

–

Hillside Focused Growth (click to open)

Investment Objective: The main objective of the “Hillside Focused Portfolio” is to derive maximum growth of capital, according to the risk tolerance of investors and their families. While protection of capital is still paramount, the PM works to deliver a 10%+ average return.

Focused Growth: An initial $1 million investment at inception would have grown to $2,621,936 as of December 31st, net of an average annual fee of 1.7%

To gain access to a complete profile of the portfolio, please be sure to email us.

| Performance to January 30, 2026 | YTD | 6 Mo | 1 Yr | 3 Yr** | 5 Yr** | 10 Yr** | Inception ** |

| Hillside Focused Growth* | -1.71% | -10.04% | -4.70% | 14.94% | 10.80% | 10.49% | 10.34% |

| HFG Benchmark2 | 1.84% | 12.65% | 17.15% | 19.26% | 13.72% | 12.31% | 10.22% |

Past performance is not an indication of future returns.

* Performance is presented gross of fees. **Inception: Sept 2, 2014. Results beyond 1 year are annualized.

2 Hillside Focused Growth Benchmark: 100% Vanguard All-Equity ETF

Source: SIACharts.com

| Hillside Focused Growth of $10000 to January 30, 2026 |

Legend:

Hillside Focused Growth

HFG Benchmark